The Russian – German Nord Stream 2 Pipeline will transport natural gas into the European Union to enhance security of supply, support climate goals and strengthen the internal energy market.

The EU’s domestic gas production is in rapid decline. To meet demand, the EU needs reliable, affordable and sustainable new gas supplies. The Nord Stream 2 Pipeline will provide this by transporting gas from the world’s largest reserves in Russia to the EU internal market.

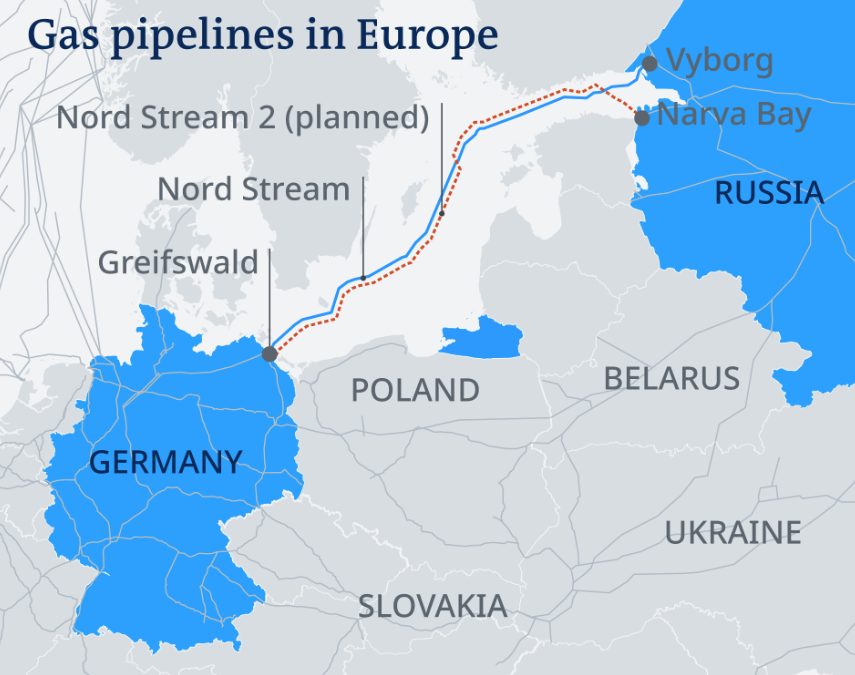

Nord Stream 2 Provides Needed Additional Capacity for Long-term Supply > A route to supply additional gas imports to the EU through the Baltic Sea to compensate for decreasing domestic gas production and fill a part of the growing demand for imported gas. > Nord Stream 2 will be a competitive additional option with direct access to some of the world’s largest natural gas reserves, making the EU’s gas supply more robust and contributing to its security of energy supply Based on the EU Reference Scenario 2016, Europe’s gas demand is projected to remain mostly stable over the coming 20 years.

At the same time, production will decline by about half, with a projected output decrease of about 25 bcm in Norway, ~25 bcm in the UK and ~40 bcm in the Netherlands. Furthermore, gas exports from Northern Africa will be increasingly constrained by own consumption while new gas from the Caspian region will deliver only small amounts to the EU. This leaves approximately 120 bcm of European gas supply to be compensated– by either LNG or Russian gas.

The share between them will be set by the market. These additional gas imports will require new infrastructure to be built, which will also enable the European gas market to better compensate supply- and demand-side uncertainties that may materialize at any time. Nord Stream 2 will be part of the solution to close the import gap and increase the security of supply in case any other import capacity or gas supply becomes unavailable or is faced by exacerbated cost and risk.

On the supply side, the Dutch regulator has capped production from the Groningen field significantly and halted production in parts. Supply from this field could be further curtailed in the future. The LNG market, on the other hand, is typically subject to cycle shifts: while there is a global market, it is clearly focused on Asia, where very little pipeline capacity exists. Once Asian demand picks up, it will outpace the build-up of new liquefaction trains and absorb any LNG in the market. Against the backdrop of rising

dw.com – German government had stressed time and again that Nord Stream 2 was primarily a business project. Weber had made his statement in Brussels as the European People’s Party’s candidate for the office of president of the European Commission, Demmer said, which was why she would “not comment on it here and now during the German government press conference.

Why America doesn’t like this deal?

The U.S Government is opposing it because it believes it will give Russia more sway in Europe and Make American LNG Less viable in Europe.