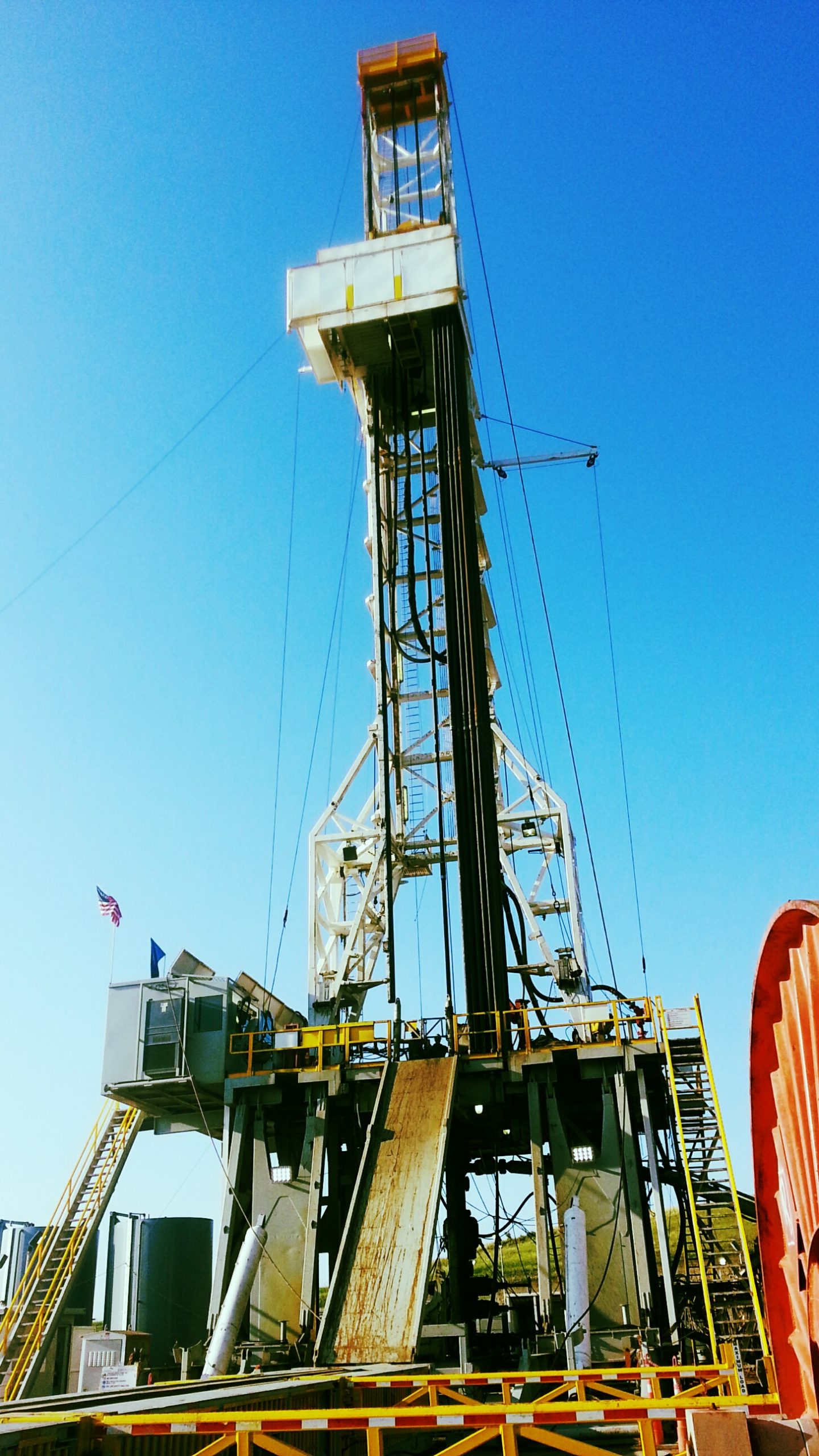

The roots of the hydraulic fracturing revolution in the U.S. bring names like EOG Resources Inc (NYSE: EOG), Pioneer Natural Resources (NYSE: PXD), Apache Corporation (NYSE: APA) and Devon Energy Corp (NYSE: DVN) on the oil side, and Range Resources Corp. (NYSE: RRC), Chesapeake Energy Corporation (NYSE: CHK) and Mitchell on the gas side. texas frac boom

Exxon Mobil said Tuesday that as soon as 2024 it expects to produce the equivalent of more than 1 million barrels of oil per day in the basin, up from a forecast of 600,000 barrels by 2025.

Exxon, the largest operator in the Permian, has 48 drilling rigs there and plans to raise that to 55 by year-end. The Irving, Texas-based company estimates that it is sitting on about 10 billion barrels of oil in the basin. Exxon looking at 1 million barrels of oil per day in the basin by 2024