Energy analysts believe oil market volatility will continue until the build-up in U.S. crude stockpiles reverses.

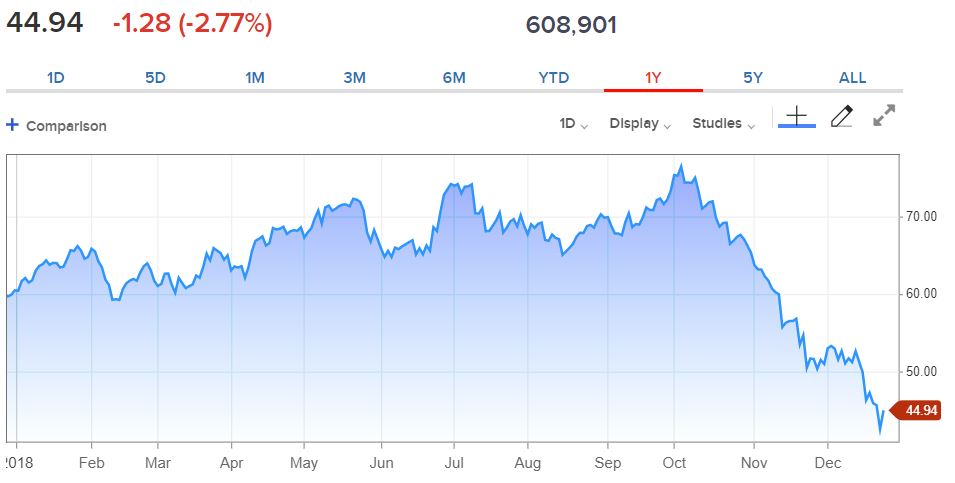

U.S. crude fell to an 18-month low on Monday, only to post its best one-day performance in more than two years on Wednesday.

Crude volatility partially due to Saudi saturation of market, says strategist from CNBC.

One catalyst for the oil market slump is Trump’s decision to allow several of Iran’s biggest customers to continue buying crude oil from the Islamic Republic despite U.S. sanctions. Anticipating strict enforcement, Saudi Arabia and several other countries hiked production before the sanctions snapped back into place last month. That pushed the market deeper into oversupply.

The U.S. government has agreed to let eight countries, including close allies South Korea and Japan, as well as India, keep buying Iranian oil after it re-imposed sanctions.

Iran’s biggest oil customers – all in Asia – had been seeking sanctions waivers to allow them to continue buying some of its oil and have argued that a total ban would spur a further rally in the price of crude.

One thought on “Crude Oil market volatility seen continuing into the New Year”